Heteroscedastic Dataset

A Heteroscedastic Dataset is a random variable dataset that is not a homoscedasticity random variable set.

- AKA: Heteroskedasticity.

- Context:

- It occurs when the variance of the error terms differ across observations.

- Example(s):

- Counter-Example(s):

- See: Statistical Deviation, Statistical Dispersion, Analysis of Variance.

References

2016

- (Wikipedia, 2016) ⇒ http://en.wikipedia.org/wiki/Heteroscedasticity 2016-08-13

- In statistics, a collection of random variables is heteroscedastic (or 'heteroskedastic' from Ancient Greek hetero “different” and skedasis “dispersion”) if there are sub-populations that have different variabilities from others. Here "variability" could be quantified by the variance or any other measure of statistical dispersion. Thus heteroscedasticity is the absence of homoscedasticity.

The existence of heteroscedasticity is a major concern in the application of regression analysis, including the analysis of variance, as it can invalidate statistical tests of significance that assume that the modelling errors are uncorrelated and uniform — hence that their variances do not vary with the effects being modeled. For instance, while the ordinary least squares estimator is still unbiased in the presence of heteroscedasticity, it is inefficient because the true variance and covariance are underestimated. Similarly, in testing for differences between sub-populations using a location test, some standard tests assume that variances within groups are equal.Because heteroscedasticity concerns expectations of the second moment of the errors, its presence is referred to as misspecification of the second order.

Definition: Suppose there is a sequence of random variables [math]\displaystyle{ \lbrace Y_{t} \rbrace_{t=1}^{n} }[/math] and a sequence of vectors of random variables, [math]\displaystyle{ \lbrace X_{t} \rbrace_{t=1}^{n} }[/math]. In dealing with conditional expectations of Yt given Xt, the sequence {Yt}t=1n is said to be heteroscedastic if the conditional variance of Yt given Xt, changes with t. Some authors refer to this as conditional heteroscedasticity to emphasize the fact that it is the sequence of conditional variances that changes and not the unconditional variance. In fact, it is possible to observe conditional heteroscedasticity even when dealing with a sequence of unconditional homoscedastic random variables; however, the opposite does not hold. If the variance changes only because of changes in value of X and not because of a dependence on the index t, the changing variance might be described using a scedastic function.

When using some statistical techniques, such as ordinary least squares (OLS), a number of assumptions are typically made. One of these is that the error term has a constant variance. This might not be true even if the error term is assumed to be drawn from identical distributions.

For example, the error term could vary or increase with each observation, something that is often the case with cross-sectional or time series measurements. Heteroscedasticity is often studied as part of econometrics, which frequently deals with data exhibiting it. While the influential 1980 paper by Halbert White used the term "heteroskedasticity" rather than "heteroscedasticity",the latter spelling has been employed more frequently in later works.

The econometrician Robert Engle won the 2003 Nobel Memorial Prize for Economics for his studies on regression analysis in the presence of heteroscedasticity, which led to his formulation of the autoregressive conditional heteroscedasticity (ARCH) modeling technique.

- In statistics, a collection of random variables is heteroscedastic (or 'heteroskedastic' from Ancient Greek hetero “different” and skedasis “dispersion”) if there are sub-populations that have different variabilities from others. Here "variability" could be quantified by the variance or any other measure of statistical dispersion. Thus heteroscedasticity is the absence of homoscedasticity.

2014

- http://stats.stackexchange.com/a/52107

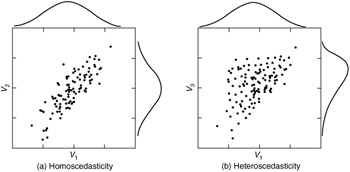

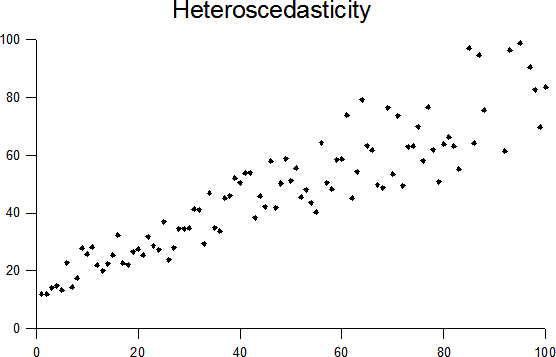

- QUOTE: Consider the plots below, which compare how homoscedastic vs. heteroscedastic data might look in these three different types of figures. Note the funnel shape for the upper two heteroscedastic plots, and the upward sloping lowess line in the last one.

- QUOTE: Consider the plots below, which compare how homoscedastic vs. heteroscedastic data might look in these three different types of figures. Note the funnel shape for the upper two heteroscedastic plots, and the upward sloping lowess line in the last one.

2002

1979

- (Breusch & Pagan, 1979) ⇒ Trevor S. Breusch, and Adrian R. Pagan. (1979). “A Simple Test for Heteroscedasticity and Random Coefficient Variation." Econometrica: Journal of the Econometric Society

- QUOTE: A simple test for heteroscedastic disturbances in a linear regression model is developed using the framework of the Lagrangian multiplier test. For a wide range of heteroscedastic and random coefficient specifications, the criterion is given as a readily computed function of the OLS residuals. Some finite sample evidence is presented to supplement the general asymptotic properties of Lagrangian multiplier tests.