2011 ChartofAccountsACriticalElement

- (Cooper & Pattanayak, 2011) ⇒ Julie Cooper, and Sailendra Pattanayak. (2011). “Chart of Accounts: A Critical Element of the Public Financial Management Framework.” International Monetary Fund.

Subject Headings: Chart of Accounts, Government-Entity CoA.

Notes

Cited By

Quotes

Author Keywords

chart of accounts, budget management, accounting, reporting, financial management

Abstract

This technical note and manual (TNM) addresses the following main issues:

- Discusses the purpose of a chart of accounts and its importance in public financial management.

- Discusses stakeholder needs in a typical public financial management framework that need to be reflected in a chart of accounts.

- Discusses the role of chart of accounts in budgetary and financial accounting.

- Discusses the relation between the chart of accounts and IFMIS.

- Explains key steps for identifying data requirements and structures for developing a chart of accounts

Introduction

The chart of accounts (COA) is often considered — in particular, by non-accountants — obscure, if not esoteric, and is often a neglected element of a country’s public financial management (PFM) system. Yet, as argued in this note, it is possibly the most critical element or lynchpin of a well-functioning PFM system. The COA, although appears to be just concerned with classifying and recording financial transactions, is critical for effective budget management, including tracking and reporting on budget execution. The structure of the budget — in particular the budget classification — and the COA have a symbiotic relationship. As such, a mistake in designing the COA could have a long lasting impact on the ability of the PFM system to provide required financial information for key decisions. The design of the COA must be planned well to take care of current management needs and potential future requirements. At the same time, the COA should be able to be changed — particularly in the context of an Integrated Financial Management Information System (IFMIS) — to respond to changes such as reorganization of government and changing needs.

Although the concept of COA is well known in the private sector, governments have only relatively recently started to apply the same accounting principles and processes commonly used by the private sector in financial management.2 The COA for a private sector entity is designed to meet the information needs of the management and the requirements of financial reporting standards. In addition to these requirements, the concept of COA used in PFM reflects the specificities of government operations and accountability requirements.

The purpose of this TNM is to demystify the COA and shed light on what a COA is; its role in the PFM framework, including budget preparation, execution and reporting; and the key principles and factors that need to be taken into consideration in designing a COA. It also discusses the specific issues associated with budgetary and financial accounting in governments and their impact on COA. The note concludes by drawing some considerations on developing and implementing a COA and its relations with an IFMIS.

I. Chart of Accounts: What it is and Why it is Important

Importance of COA in PFM systems

- A well-functioning PFM framework includes an effective accounting and financial reporting system to support fiscal policy analysis and budget management.

Among other things, government business processes and decisions are anchored on the flow of specific financial information / data between various stakeholders. Providing such information on government activities is an important function of the accounting and reporting system which should capture, classify, record, and communicate relevant, reliable, and comparable financial information for at least the following purposes: budgetary accounting and reporting, including reporting of actual against approved budget estimates; general purpose financial reporting; management information; and statistical reporting. This system underpins the collection and use of public resources and informs policy makers, managers of government agencies, parliamentarians and the public at large on government policies and operations.

- The COA is the lynchpin of a government’s accounting and reporting system and serves as a key tool to meet its business requirements.

Recording and reporting financial information requires keeping a chronological log of transactions and events measured in monetary terms and classified and summarized in a useful format based on the business needs of the organization. This is achieved with the help of a COA. Raw data is not very useful until it has been appropriately classified and summarized into meaningful information by using an appropriate COA. With a poorly designed COA, straightforward tasks such as the preparation of standard reports become onerous and often require human and spreadsheet intervention. It becomes difficult to retrieve and reconcile the required financial data and the financial reports become unreliable.

What is a COA?

- The COA is a critical element of the PFM framework for classifying, recording and reporting information on financial plans, transactions and events in a systematic and consistent way.

The COA is an organized and coded listing of all the individual accounts that are used to record transactions and make up the ledger system. In particular:

- The COA specifies how the financial transactions are recorded in a series of accounts that are required to be maintained to support the needs of various users / stakeholders. It defines the scope and content of these accounts for capturing the relevant financial information. This series of accounts is called the General Ledger (GL) and subsidiary ledgers, which record all transactions as per specifications in the COA.3

- The COA provides a coding structure for the classification and recording of relevant financial information (both flows and stocks) within the financial management and reporting system.

The classification structure (see Box 1 for examples of classifications commonly used) should not only meet the legal and administrative requirements for budget management and financial reporting, but should also conform to certain international standards on financial and statistical reporting (discussed below). For budget management purposes, the COA should meet the requirements of planning, controlling and reporting of budgetary allocations / appropriations as well as internal management needs of budget units and/or cost centers.

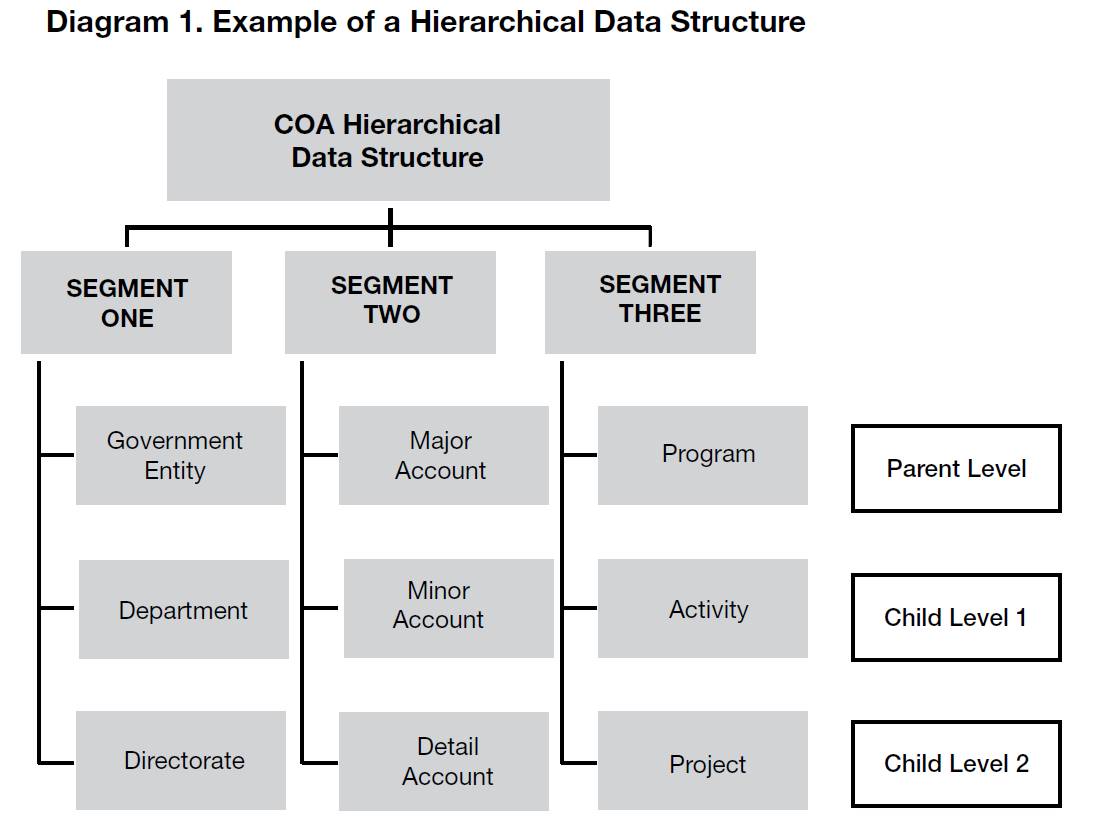

- The COA configuration represents the hierarchical structures of groups of classifications of information requirements

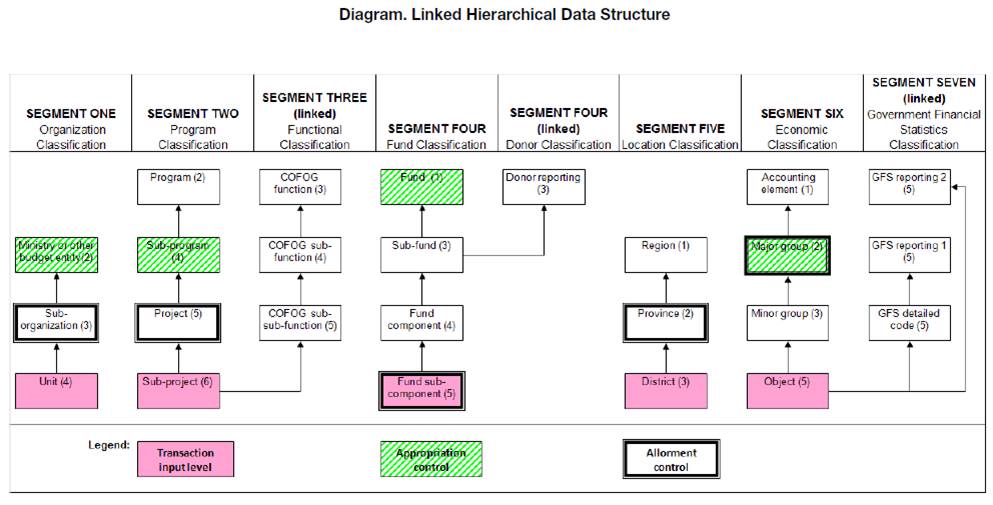

(see Diagram 1 for an example of a hierarchical structure). Each classification group is often called a segment and identifies a discrete information requirement for management, reporting and control purposes. Each segment can be combined with the others to create financial reports and enforce controls with a view to meeting the needs of various users and complying with the laws and regulations in the PFM area. The combinations of segments and the numbering sequence of the coding structure are used to record data in respect to budget related and other financial transactions and to generate budget execution reports, financial statements and internal management reporting information. For effective management, the COA should cover all transactions (flows) and balances (stocks) of the reporting entity for budget management and general purpose financial reporting (see Box 2 for the “reporting entity” concept and how it relates to the budgetary sector). Governments produce not only general purpose financial statements, but also other types of fiscal reports. The COA should facilitate (i) the required control features and management information requirements at different stages of budget execution; and (ii) reporting to various internal and external stakeholders. With an IFMIS, the needs of all stakeholders can be met with one unified or common COA. A unified COA is configured with a hierarchical set of linked codes based on parent-child relationships, with lower level codes being used by individual accounting units and higher level codes used for consolidation of accounting/financial information (see the diagram in Annex for an example of linked segments and codes that will provide the required financial reports while effectively controlling budget execution).

II. The role of Chart of Accounts in Government Systems

The COA’s definition and use in government systems are influenced by different PFM traditions. Countries have developed different approaches to address the information needs of governments and as a result actual practices differ across countries. This is also due to the fact that each country, based on its legal and administrative tradition, needs to have systems that cater to specific control and information requirements for government budget management.

…

…

Annex

References

;

| Author | volume | Date Value | title | type | journal | titleUrl | doi | note | year | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2011 ChartofAccountsACriticalElement | Julie Cooper Sailendra Pattanayak | Chart of Accounts: A Critical Element of the Public Financial Management Framework | 2011 |