2013 StrikingItRicherTheEvolutionofT

- (Saez, 2013) ⇒ Emmanuel Saez. (2013). “Striking It Richer: The Evolution of Top Incomes in the United States (updated with 2012 Preliminary Estimates).” Technical Report: University of California, Berkeley, Department of Economics.

Subject Headings: U.S. Wealth Inequality

Notes

Cited By

Quotes

What's new for recent years?

- 2009-2012

- Uneven recovery from the Great Recession

From 2009 to 2012, average real income per family grew modestly by 6.0% (Table 1). Most of the gains happened in the last year when average incomes grew by 4.6% from 2011 to 2012.

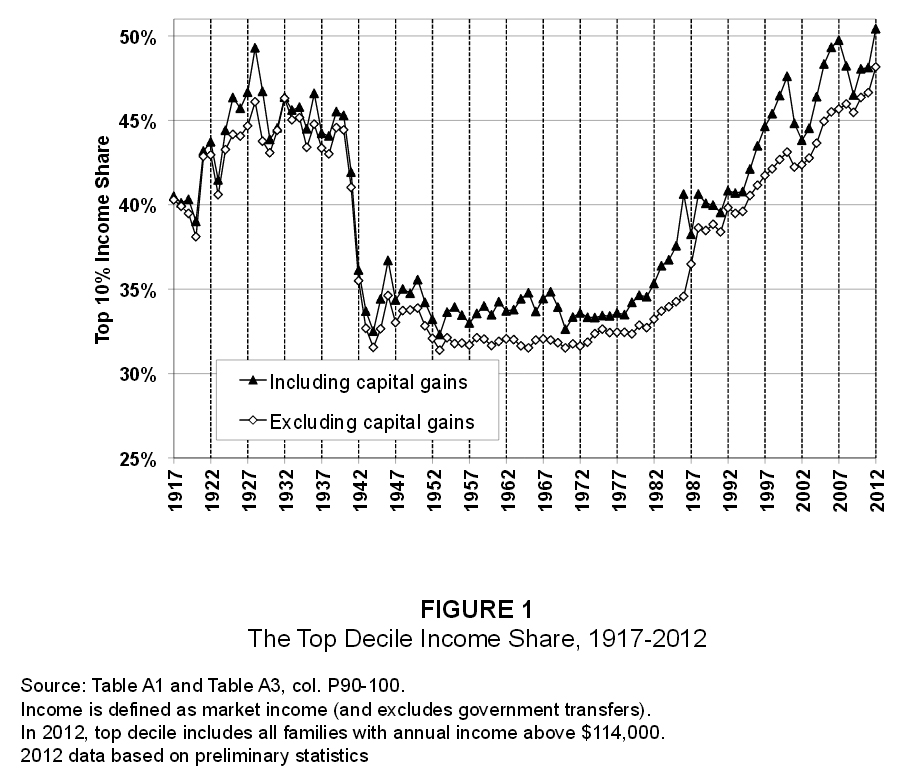

However, the gains were very uneven. Top 1% incomes grew by 31.4% while bottom 99% incomes grew only by 0.4% from 2009 to 2012. Hence, the top 1% captured 95% of the income gains in the first three years of the recovery. From 2009 to 2010, top 1% grew fast and then stagnated from 2010 to 2011. Bottom 99% stagnated both from 2009 to 2010 and from 2010 to 2011. In 2012, top 1% incomes increased sharply by 19.6% while bottom 99% incomes grew only by 1.0%. In sum, top 1% incomes are close to full recovery while bottom 99% incomes have hardly started to recover. Note that 2012 statistics are based on preliminary projections and will be updated in January 2014 when more complete statistics become available. Note also that part of the surge of top 1% incomes in 2012 could be due to income retiming to take advantage of the lower top tax rates in 2012 relative to 2013 and after.[1] Retiming should be most prevalent for realized capital gains as individuals have great flexibility in the timing of capital gains realizations. However, series for income excluding realized capital gains also show a very sharp increase (Figure 1), suggesting that retiming likely explains only part of the surge in top 1% incomes in 2012. Retiming of income should produce a dip in top reported incomes in 2013. Hence, statistics for 2013 will show how important retiming was in the surge in top incomes from 2011 to 2012.

Overall, these results suggest that the Great Recession has only depressed top income shares temporarily and will not undo any of the dramatic increase in top income shares that has taken place since the 1970s. Indeed, the top decile income share in 2012 is equal to 50.4%, the highest ever since 1917 when the series start (Figure 1).

Looking further ahead, based on the US historical record, falls in income concentration due to economic downturns are temporary unless drastic regulation and tax policy changes are implemented and prevent income concentration from bouncing back. Such policy changes took place after the Great Depression during the New Deal and permanently reduced income concentration until the 1970s (Figures 2, 3). In contrast, recent downturns, such as the 2001 recession, lead to only very temporary drops in income concentration (Figures 2, 3).

The policy changes that took place coming out of the Great Recession (financial regulation and top tax rate increase in 2013) are not negligible but they are modest relative to the policy changes that took place coming out of the Great Depression. Therefore, it seems unlikely that US income concentration will fall much in the coming years.

Great Recession 2007-2009

During the Great Recession, from 2007 to 2009, average real income per family declined dramatically by 17.4% (Table 1), This decline is much larger than the real official GDP decline of 3.1% from 2007-2009 for several reasons. First, our income measure includes realized capital gains while realized capital gains are not included in GDP. Our average real income measure excluding capital gains decreased by 10.8% (instead of 17.4%). Second, the total number of US families increased by 2.5% from 2007 to 2009 mechanically reducing income growth per family relative to aggregate income growth. Third, nominal GDP decreased by 0.6% while the total market nominal income aggregate we use (when excluding realized capital gains) decreased by 5.5%. This discrepancy is due to several factors: (a) nominal GDP decreased only by 0.4% while nominal National Income (conceptually closer to our measure) decreased by 2%. In net, income items included in National Income but excluded from our income measure grew over the 2007-2009 period. The main items are supplements to wages and salaries (mostly employer provided benefits), rental income of persons (which imputes rents for homeowners), and undistributed profits of corporations (see National Income by Type of Income, Table 1.12, http://www.bea.gov/national/nipaweb/SelectTable.asp).</ref> the largest two-year drop since the Great Depression. Average real income for the top percentile fell even faster (36.3 percent decline, Table 1), which lead to a decrease in the top percentile income share from 23.5 to 18.1 percent (Figure 2). Average real income for the bottom 99% also fell sharply by 11.6%, also by far the largest two-year decline since the Great Depression. This drop of 11.6% more than erases the 6.8% income gain from 2002 to 2007 for the bottom 99%.

The fall in top decile income share from 2007 to 2009 is actuallyduring the 2001 recession from 2000 to 2002, in part because the Great recession has hit bottom 99% incomes much harder than the 2001 recession (Table 1), and in part because upper incomes excluding realized capital gains have resisted relatively well during the Great Recession.

New Filing Season Distributional Statistics

…

Footnotes

- ↑ Top ordinary income marginal tax rates increased from 35 to 39.6% and top income tax rates on realized capital gains and dividends increased from 15 to 20% in 2013. In addition, the Affordable Care Act surtax at marginal rate of 3.8% on top capital incomes and 0.9% on top labor incomes was added in 2013 (the surtax is only 0.9% on labor income due to the pre-existing Medicare tax of 2.9% on labor income). The Pease limitation on itemized deductions also increases marginal tax rates by about 1 percentage point in 2013. These higher marginal tax rates affect approximately the top 1%. Hence, among top earners, retiming income from 2013 to 2012 saves about 6.5 percentage points of marginal tax for labor income and about 10 percentage points for capital income. In words, for top 1% earners, shifting an extra $100 of labor income from 2013 to 2012 saves about $6.5 in taxes and shifting an extra $100 of capital income from 2013 to 2012 saves about $10 in taxes.

References

;

| Author | volume | Date Value | title | type | journal | titleUrl | doi | note | year | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2013 StrikingItRicherTheEvolutionofT | Emmanuel Saez | 2013 |

[[title::Striking It Richer: The Evolution of Top Incomes in the United States (updated with 2012 Preliminary Estimates)|]]