2014 CapitalintheTwentyFirstCentury

- (Piketty, 2014) ⇒ Thomas Piketty. (2014). “Capital in the Twenty-First Century.” Harvard University Press. ISBN:9780674369559

Subject Headings: Just Society; Wealth Inequality; Capital and Labor Substitution Elasticity; Capital/Income Ratio, Capital-Intensive Economic Theory.

Notes

- Book Presentation Slides: http://piketty.pse.ens.fr/files/Piketty2014Capital21c.pdf

- It proposes that Return-on-Capital is typically Greater-Than Economic-Growth (i.e. [math]\displaystyle{ r \gt g }[/math]).

- It suggests that we will need to implement a Global Tax on Capital.

Cited By

2014

- The Economist Explains. (2014). “Thomas Piketty’s “Capital”, summarised in four paragraphs.” The Economist May 4th 2014.

- QUOTE: … “ Capital” is built on more than a decade of research by Mr Piketty and a handful of other economists, detailing historical changes in the concentration of income and wealth. This pile of data allows Mr Piketty to sketch out the evolution of inequality since the beginning of the industrial revolution. In the 18th and 19th centuries western European society was highly unequal. Private wealth dwarfed national income and was concentrated in the hands of the rich families who sat atop a relatively rigid class structure. This system persisted even as industrialisation slowly contributed to rising wages for workers. Only the chaos of the first and second world wars and the Depression disrupted this pattern. High taxes, inflation, bankruptcies, and the growth of sprawling welfare states caused wealth to shrink dramatically, and ushered in a period in which both income and wealth were distributed in relatively egalitarian fashion. But the shocks of the early 20th century have faded and wealth is now reasserting itself. On many measures, Mr Piketty reckons, the importance of wealth in modern economies is approaching levels last seen before the first world war.

From this history, Mr Piketty derives a grand theory of capital and inequality. As a general rule wealth grows faster than economic output, he explains, a concept he captures in the expression r > g (where r is the rate of return to wealth and g is the economic growth rate). Other things being equal, faster economic growth will diminish the importance of wealth in a society, whereas slower growth will increase it (and demographic change that slows global growth will make capital more dominant). But there are no natural forces pushing against the steady concentration of wealth. Only a burst of rapid growth (from technological progress or rising population) or government intervention can be counted on to keep economies from returning to the “patrimonial capitalism” that worried Karl Marx. Mr Piketty closes the book by recommending that governments step in now, by adopting a global tax on wealth, to prevent soaring inequality contributing to economic or political instability down the road. …

- QUOTE: … “ Capital” is built on more than a decade of research by Mr Piketty and a handful of other economists, detailing historical changes in the concentration of income and wealth. This pile of data allows Mr Piketty to sketch out the evolution of inequality since the beginning of the industrial revolution. In the 18th and 19th centuries western European society was highly unequal. Private wealth dwarfed national income and was concentrated in the hands of the rich families who sat atop a relatively rigid class structure. This system persisted even as industrialisation slowly contributed to rising wages for workers. Only the chaos of the first and second world wars and the Depression disrupted this pattern. High taxes, inflation, bankruptcies, and the growth of sprawling welfare states caused wealth to shrink dramatically, and ushered in a period in which both income and wealth were distributed in relatively egalitarian fashion. But the shocks of the early 20th century have faded and wealth is now reasserting itself. On many measures, Mr Piketty reckons, the importance of wealth in modern economies is approaching levels last seen before the first world war.

Quotes

Book Overview

What are the grand dynamics that drive the accumulation and distribution of capital? Questions about the long-term evolution of inequality, the concentration of wealth, and the prospects for economic growth lie at the heart of political economy. But satisfactory answers have been hard to find for lack of adequate data and clear guiding theories. In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Piketty shows that modern economic growth and the diffusion of knowledge have allowed us to avoid inequalities on the apocalyptic scale predicted by Karl Marx. But we have not modified the deep structures of capital and inequality as much as we thought in the optimistic decades following World War II. The main driver of inequality- - the tendency of returns on capital to exceed the rate of economic growth--today threatens to generate extreme inequalities that stir discontent and undermine democratic values. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, Piketty says, and may do so again.

A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today.

Introduction

- “Social distinctions can be based only on common utility.” — Declaration of the Rights of Man and the Citizen, article 1, 1789

I. Income and Capital

1. Income and Output

2. Growth: Illusions and Realities

II. The Dynamics of the Capital/Income Ratio

3. The Metamorphoses of Capital

4. From Old Europe to the New World

5. The Capital/Income Ratio over the Long Run

6. The Capital–Labor Split in the Twenty-First Century

III. The Structure of Inequality

7. Inequality and Concentration: Preliminary Bearings

8. Two Worlds

9. Inequality of Labor Income

10. Inequality of Capital Ownership

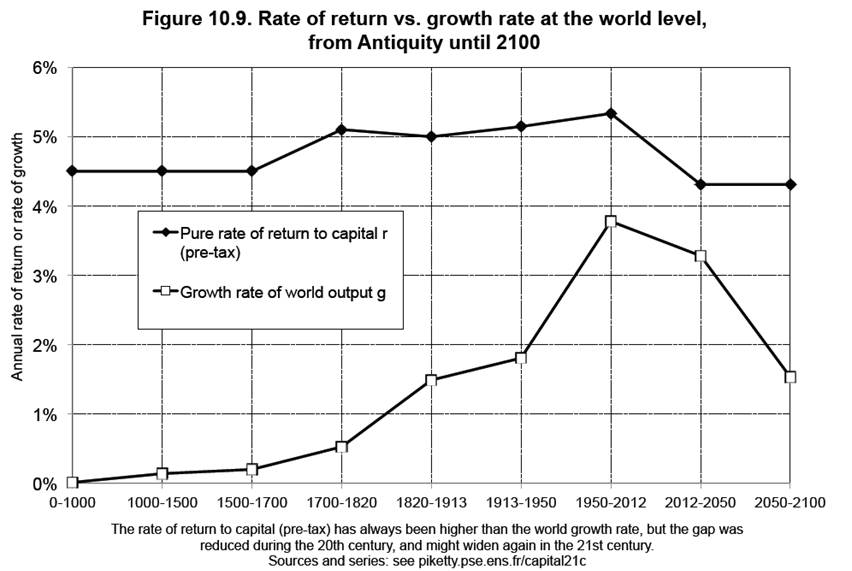

FIGURE 10.9. Rate of return versus growth rate at the [[world level], from Antiquity until 2100 The rate of return to capital (pretax) has always been higher than the world growth rate, but the gap was reduced during the twentieth century, and might widen again in the twenty-first century. Sources and series: see http://piketty.pse.ens.fr/capital21c

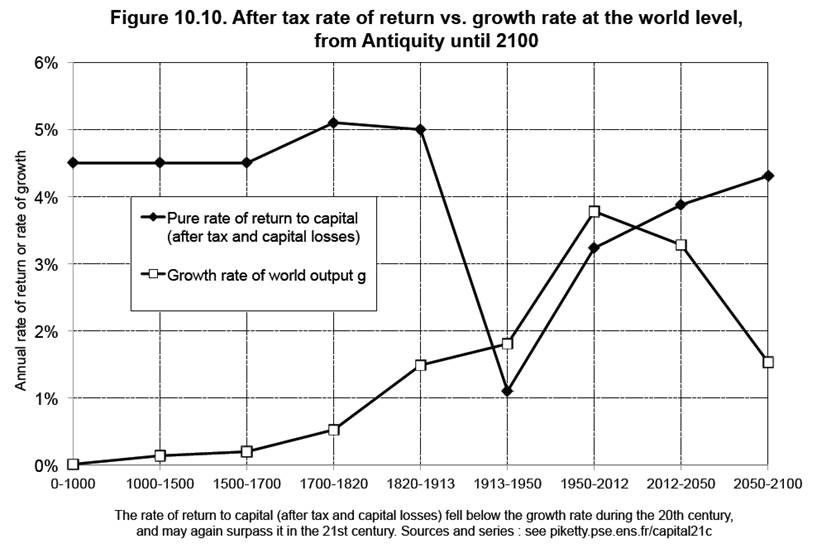

Figure 10.10. After tax rate of return versus growth rate at the world level, from Antiquity until 2100 The rate of return to capital (after tax and capital losses) fell below the growth rate during the twentieth century, and might again surpass it in the twenty-first century. Sources and series: see http://piketty.pse.ens.fr/capital21c .

NOT INCLUDED

Figure 10.11. After tax rate of return versus growth rate at the world level, from Antiquity until 2200 The rate of return to capital (after tax and capital losses) fell below the growth rate during the twentieth century, and might twenty-first century. Sources and series: see http://piketty.pse.ens.fr/capital21c .

11. Merit and Inheritance in the Long Run

12. Global Inequality of Wealth in the Twenty-First Century

IV. Regulating Capital in the Twenty-First Century

13. A Social State for the Twenty-First Century

14. Rethinking the Progressive Income Tax

15. A Global Tax on Capital

16. The Question of the Public Debt

to regulate the globalized patrimonial capitalism of the twenty-first century, rethinking the twentieth-century fiscal and social model and adapting it to today's world will not be enough. …

…

A Global Tax on Capital: A Useful Utopia

A Global tax on capital is a utopian idea …

…

Conclusion

I have presented the current state of our historical knowledge concerning the dynamics of the distribution of wealth and income since the eighteenth century, and I have attempted to draw from this knowledge whatever lessons can be drawn for the century ahead.

The sources on which this book draws are more extensive than any previous author has assembled, but they remain imperfect and incomplete. All of my conclusions are by nature tenuous and deserve to be questioned and debated. It is not the purpose of social science research to produce mathematical certainties that can substitute for open, democratic debate in which all shades of opinion are represented.

The Central Contradiction of Capitalism: r > g

The overall conclusion of this study is that a market economy based on private property, if left to itself, contains powerful forces of convergence, associated in particular with the diffusion of knowledge and skills; but it also contains powerful forces of divergence, which are potentially threatening to democratic societies and to the values of social justice on which they are based.

The principal destabilizing force has to do with the fact that the private rate of return on capital, r, can be significantly higher for long periods of time than the rate of growth of income and output, g.

The inequality r > g implies that wealth accumulated in the past grows more rapidly than output and wages. This inequality expresses a fundamental logical contradiction. The entrepreneur inevitably tends to become a rentier, more and more dominant over those who own nothing but their labor. Once constituted, capital reproduces itself faster than output increases. The past devours the future.

The consequences for the long-term dynamics of the wealth distribution are potentially terrifying, especially when one adds that the return on capital varies directly with the size of the initial stake and that the divergence in the wealth distribution is occurring on a global scale.

The problem is enormous, and there is no simple solution. Growth can of course be encouraged by investing in education, knowledge, and nonpolluting technologies. But none of these will raise the growth rate to 4 or 5 percent a year. History shows that only countries that are catching up with more advanced economies — such as Europe during the three decades after World War II or China and other emerging countries today — can grow at such rates. For countries at the world technological frontier — and thus ultimately for the planet as a whole — there is ample reason to believe that the growth rate will not exceed 1– 1.5 percent in the long run, no matter what economic policies are adopted. 1

With an average return on capital of 4–5 percent, it is therefore likely that r > g will again become the norm in the twenty -first century, as it had been throughout history until the eve of World War I. In the twentieth century, it took two world wars to wipe away the past and significantly reduce the return on capital, thereby creating the illusion that the fundamental structural contradiction of capitalism (r > g) had been overcome.

To be sure, one could tax capital income heavily enough to reduce the private return on capital tothe growth rate. But if one did that indiscriminately and heavy-handedly, one would risk killing the motor of accumulation and thus further reducing the growth rate. Entrepreneurs would then no longer have the time to turn into rentiers, since there would be no more entrepreneurs.

The right solution is a progressive annual tax on capital. This will make it possible to avoid an endless inegalitarian spiral while preserving competition and incentives for new instances of primitive accumulation. For example, I earlier discussed the possibility of a capital tax schedule with rates of 0.1 or 0.5 percent on fortunes under 1 million euros, 1 percent on fortunes between 1 and 5 million euros, 2 percent between 5 and 10 million euros, and as high as 5 or 10 percent for fortunes of several hundred million or several billion euros. This would contain the unlimited growth of global inequality of wealth, which is currently increasing at a rate that cannot be sustained in the long run and that ought to worry even the most fervent champions of the self-regulated market. Historical experience shows, moreover, that such immense inequalities of wealth have little to do with the entrepreneurial spirit and are of no use in promoting growth. Nor are they of any “common utility,” to borrow the nice expression from the 1789 Declaration of the Rights of Man and the Citizen with which I began this book.

The difficulty is that this solution, the progressive tax on capital , requires a high level of international cooperation and regional political integration. It is not within the reach of the nation-states in which earlier social compromises were hammered out. Many people worry that moving toward greater cooperation and political integration within, say, the European Union only undermines existing achievements (starting with the social states that the various countries of Europe constructed in response to the shocks of the twentieth century) without constructing anything new other than a vast market predicated on ever purer and more perfect competition. Yet pure and perfect competition cannot alter the inequality r > g, which is not the consequence of any market “imperfection .” On the contrary. Although the risk is real, I do not see any genuine alternative: if we are to regain control of capitalism, we must bet everything on democracy — and in Europe, democracy on a European scale. Larger political communities such as the United States and China have a wider range of options, but for the small countries of Europe, which will soon look very small indeed in relation to the global economy, national withdrawal can only lead to even worse frustration and disappointment than currently exists with the European Union. The nation-state is still the right level at which to modernize any number of social and fiscal policies and to develop new forms of governance and shared ownership intermediate between public and private ownership , which is one of the major challenges for the century ahead. But only regional political integration can lead to effective regulation of the globalized patrimonial capitalism of the twenty-first century.

For a Political and Historical Economics

I would like to conclude with a few words about economics and social science. As I made clear in the introduction, I see economics as a subdiscipline of the social sciences, alongside history, sociology, anthropology, and political science. I hope that this book has given the reader an idea of what I mean by that. I dislike the expression “economic science,” which strikes me as terribly arrogant because it suggests that economics has attained a higher scientific status than the other social sciences. I much prefer the expression “political economy,” which may seem rather old-fashioned but to my mind conveys the only thing that sets economics apart from the other social sciences: its political, normative, and moral purpose.

From the outset, political economy sought to study scientifically, or at any rate rationally, systematically, and methodically, the ideal role of the state in the economic and social organization of a country. The question it asked was: What public policies and institutions bring us closer to an ideal society? This unabashed aspiration to study good and evil, about which every citizen is an expert, may make some readers smile . To be sure, it is an aspiration that often goes unfulfilled . But it is also a necessary, indeed indispensable, goal, because it is all too easy for social scientists to remove themselves from public debate and political confrontation and content themselves with the role of commentators on or demolishers of the views and data of others. Social scientists, like all intellectuals and all citizens, ought to participate in public debate. They cannot be content to invoke grand but abstract principles such as justice, democracy, and world peace. They must make choices and take stands in regard to specific institutions and policies, whether it be the social state, the tax system, or the public debt. Everyone is political in his or her own way. The world is not divided between a political elite on one side and, on the other, an army of commentators and spectators whose only responsibility is to drop a ballot in a ballot box once every four or five years. It is illusory, I believe , to think that the scholar and the citizen live in separate moral universes, the former concerned with means and the latter with ends. Although comprehensible, this view ultimately strikes me as dangerous.

For far too long economists have sought to define themselves in terms of their supposedly scientific methods. In fact, those methods rely on an immoderate use of mathematical models, which are frequently no more than an excuse for occupying the terrain and masking the vacuity of the content. Too much energy has been and still is being wasted on pure theoretical speculation without a clear specification of the economic facts one is trying to explain or the social and political problems one is trying to resolve. Economists today are full of enthusiasm for empirical methods based on controlled experiments. When used with moderation, these methods can be useful, and they deserve credit for turning some economists toward concrete questions and firsthand knowledge of the terrain (a long overdue development). But these new approaches themselves succumb at times to a certain scientistic illusion. It is possible, for instance, to spend a great deal of time proving the existence of a pure and true causal relation while forgetting that the question itself is of limited interest. The new methods often lead to a neglect of history and of the fact that historical experience remains our principal source of knowledge. We cannot replay the history of the twentieth century as if World War I never happened or as if the income tax and PAYGO pensions were never created. To be sure, historical causality is always difficult to prove beyond a shadow of a doubt. Are we really certain that a particular policy had a particular effect, or was the effect perhaps due to some other cause? Nevertheless, the imperfect lessons that we can draw from history, and in particular from the study of the last century, are of inestimable, irreplaceable value, and no controlled experiment will ever be able to equal them. To be useful, economists must above all learn to be more pragmatic in their methodological choices, to make use of whatever tools are available, and thus to work more closely with other social science disciplines.

Conversely, social scientists in other disciplines should not leave the study of economic facts to economists and must not flee in horror the minute a number rears its head, or content themselves with saying that every statistic is a social construct, which of course is true but insufficient. At bottom, both responses are the same , because they abandon the terrain to others.

The Interests of the Least Well-Off

“As long as the incomes of the various classes of contemporary society remain beyond the reach of scientific inquiry, there can be no hope of producing a useful economic and social history.” This admirable sentence begins Le mouvement du profit en France au 19e siècle, which Jean Bouvier, François Furet, and Marcel Gillet published in 1965. The book is still worth reading, in part because it is a good example of the “serial history ” that flourished in France between 1930 and 1980, with its characteristic virtues and flaws, but even more because it reminds us of the intellectual trajectory of François Furet, whose career offers a marvelous illustration of both the good and the bad reasons why this research program eventually died out.

When Furet began his career as a promising young historian, he chose a subject that he believed was at the center of contemporary research : “the incomes of the various classes of contemporary society.” The book is rigorous, eschews all prejudgment, and seeks above all to collect data and establish facts. Yet this would be Furet’s first and last work in this realm. In the splendid book he published with Jacques Ozouf in 1977, Lire et écrire, devoted to “literacy in France from Calvin to Jules Ferry,” one finds the same eagerness to compile serial data, no longer about industrial profits but now about literacy rates, numbers of teachers, and educational expenditures. In the main, however, Furet became famous for his work on the political and cultural history of the French Revolution, in which one endeavors in vain to find any trace of the “incomes of the various classes of contemporary society,” and in which the great historian , preoccupied as he was in the 1970s with the battle he was waging against the Marxist historians of the French Revolution (who at the time were particularly dogmatic and clearly dominant, notably at the Sorbonne), seems to have turned against economic and social history of any kind. To my mind, this is a pity, since I believe it is possible to reconcile the different approaches. Politics and ideas obviously exist independently of economic and social evolutions. Parliamentary institutions and the government of laws were never merely the bourgeois institutions that Marxist intellectuals used to denounce before the fall of the Berlin Wall. Yet it is also clear that the ups and downs of prices and wages, incomes and fortunes, help to shape political perceptions and attitudes, and in return these representations engender political institutions, rules, and policies that ultimately shape social and economic change. It is possible, and even indispensable, to have an approach that is at once economic and political, social and cultural, and concerned with wages and wealth. The bipolar confrontations of the period 1917– 1989 are now clearly behind us. The clash of communism and capitalism sterilized rather than stimulated research on capital and inequality by historians, economists, and even philosophers. 2 It is long since time to move beyond these old controversies and the historical research they engendered, which to my mind still bears their stamp.

As I noted in the introduction, there are also technical reasons for the premature death of serial history. The material difficulty of collecting and processing large volumes of data in those days probably explains why works in this genre (including Le mouvement du profit en France au 19e siècle) had little room for historical interpretation, which makes reading them rather arid. In particular, there is often very little analysis of the relation between observed economic changes and the political and social history of the period under study. Instead, one gets a meticulous description of the sources and raw data, information that is more naturally presented nowadays in spreadsheets and online databases.

I also think that the demise of serial history was connected with the fact that the research program petered out before it reached the twentieth century. In studying the eighteenth or nineteenth centuries it is possible to think that the evolution of prices and wages, or incomes and wealth, obeys an autonomous economic logic having little or nothing to do with the logic of politics or culture . When one studies the twentieth century, however, such an illusion falls apart immediately. A quick glance at the curves describing income and wealth inequality or the capital/ income ratio is enough to show that politics is ubiquitous and that economic and political changes are inextricably intertwined and must be studied together. This forces one to study the state, taxes, and debt in concrete ways and to abandon simplistic and abstract notions of the economic infrastructure and political superstructure.

To be sure, the principle of specialization is sound and surely makes it legitimate for some scholars to do research that does not depend on statistical series. There are a thousand and one ways to do social science, and accumulating data is not always indispensable or even (I concede) especially imaginative. Yet it seems to me that all social scientists, all journalists and commentators, all activists in the unions and in politics of whatever stripe, and especially all citizens should take a serious interest in money, its measurement, the facts surrounding it, and its history. Those who have a lot of it never fail to defend their interests. Refusing to deal with numbers rarely serves the interests of the least well-off.

Tables and Illustrations

Tables

Table 1.1. Distribution of world GDP, 2012

Table 2.1. World growth since the Industrial Revolution

Table 2.2. The law of cumulated growth

Table 2.3. Demographic growth since the Industrial Revolution

Table 2.4. Employment by sector in France and the United States, 1800–2012

Table 2.5. Per capita output growth since the Industrial Revolution

Table 3.1. Public wealth and private wealth in France in 2012

Table 5.1. Growth rates and saving rates in rich countries, 1970–2010

Table 5.2. Private saving in rich countries, 1970–2010

Table 5.3. Gross and net saving in rich countries, 1970–2010

Table 5.4. Private and public saving in rich countries, 1970–2010

Table 7.1. Inequality of labor income across time and space

Table 7.2. Inequality of capital ownership across time and space

Table 7.3. Inequality of total income (labor and capital) across time and space

Table 10.1. The composition of Parisian portfolios, 1872–1912

Table 11.1. The age–wealth profile in France, 1820–2010

Table 12.1. The growth rate of top global wealth, 1987–2013

Table 12.2. The return on the capital endowments of US universities, 1980–2010

Illustrations

Figure I.1. Income inequality in the United States, 1910–2010

Figure I.2. The capital/income ratio in Europe, 1870–2010

Figure 1.1. The distribution of world output, 1700–2012

Figure 1.2. The distribution of world population, 1700–2012

Figure 1.3. Global inequality 1700–2012: divergence then convergence?

Figure 1.4. Exchange rate and purchasing power parity: euro/dollar

Figure 1.5. Exchange rate and purchasing power parity: euro/yuan

Figure 2.1. The growth of world population, 1700–2012

Figure 2.2. The growth rate of world population from Antiquity to 2100

Figure 2.3. The growth rate of per capita output since the Industrial Revolution

Figure 2.4. The growth rate of world per capita output from Antiquity to 2100

Figure 2.5. The growth rate of world output from Antiquity to 2100

Figure 2.6. Inflation since the Industrial Revolution

Figure 3.1. Capital in Britain, 1700–2010

Figure 3.2. Capital in France, 1700–2010

Figure 3.3. Public wealth in Britain, 1700–2010

Figure 3.4. Public wealth in France, 1700–2010

Figure 3.5. Private and public capital in Britain, 1700–2010

Figure 3.6. Private and public capital in France, 1700–2010

Figure 4.1. Capital in Germany, 1870–2010

Figure 4.2. Public wealth in Germany, 1870–2010

Figure 4.3. Private and public capital in Germany, 1870–2010

Figure 4.4. Private and public capital in Europe, 1870–2010

Figure 4.5. National capital in Europe, 1870–2010

Figure 4.6. Capital in the United States, 1770–2010

Figure 4.7. Public wealth in the United States, 1770–2010

Figure 4.8. Private and public capital in the United States, 1770–2010

Figure 4.9. Capital in Canada, 1860–2010

Figure 4.10. Capital and slavery in the United States

Figure 4.11. Capital around 1770–1810: Old and New World

Figure 5.1. Private and public capital: Europe and the United States, 1870–2010

Figure 5.2. National capital in Europe and America, 1870–2010

Figure 5.3. Private capital in rich countries, 1970–2010

Figure 5.4. Private capital measured in years of disposable income

Figure 5.5. Private and public capital in rich countries, 1970–2010

Figure 5.6. Market value and book value of corporations

Figure 5.7. National capital in rich countries, 1970–2010

Figure 5.8. The world capital/income ratio, 1870–2100

Figure 6.1. The capital–labor split in Britain, 1770–2010

Figure 6.2. The capital–labor split in France, 1820–2010

Figure 6.3. The pure return on capital in Britain, 1770–2010

Figure 6.4. The pure rate of return on capital in France, 1820–2010

Figure 6.5. The capital share in rich countries, 1975–2010

Figure 6.6. The profit share in the value added of corporations in France, 1900–2010

Figure 6.7. The share of housing rent in national income in France, 1900–2010

Figure 6.8. The capital share in national income in France, 1900–2010

Figure 8.1. Income inequality in France, 1910–2010

Figure 8.2. The fall of rentiers in France, 1910–2010

Figure 8.3. The composition of top incomes in France in 1932

Figure 8.4. The composition of top incomes in France in 2005

Figure 8.5. Income inequality in the United States, 1910–2010

Figure 8.6. Decomposition of the top decile, United States, 1910–2010

Figure 8.7. High incomes and high wages in the United States, 1910–2010

Figure 8.8. The transformation of the top 1 percent in the United States

Figure 8.9. The composition of top incomes in the United States in 1929

Figure 8.10. The composition of top incomes in the United States, 2007

Figure 9.1. Minimum wage in France and the United States, 1950–2013

Figure 9.2. Income inequality in Anglo-Saxon countries, 1910–2010

Figure 9.3. Income inequality in Continental Europe and Japan, 1910–2010

Figure 9.4. Income inequality in Northern and Southern Europe, 1910–2010

Figure 9.5. The top decile income share in Anglo-Saxon countries, 1910–2010

Figure 9.6. The top decile income share in Continental Europe and Japan, 1910–2010

Figure 9.7. The top decile income share in Europe and the United States, 1900–2010

Figure 9.8. Income inequality in Europe versus the United States, 1900–2010

Figure 9.9. Income inequality in emerging countries, 1910–2010

Figure 10.1. Wealth inequality in France, 1810–2010

Figure 10.2. Wealth inequality in Paris versus France, 1810–2010

Figure 10.3. Wealth inequality in Britain, 1810–2010

Figure 10.4. Wealth inequality in Sweden, 1810–2010

Figure 10.5. Wealth inequality in the United States, 1810–2010

Figure 10.6. Wealth inequality in Europe versus the United States, 1810–2010

Figure 10.7. Return to capital and growth: France, 1820–1913

Figure 10.8. Capital share and saving rate: France, 1820–1913

Figure 10.9. Rate of return versus growth rate at the world level, from Antiquity until 2100

Figure 10.10. After tax rate of return versus growth rate at the world level, from Antiquity until 2100

Figure 10.11. After tax rate of return versus growth rate at the world level, from Antiquity until 2200

Figure 11.1. The annual inheritance flow as a fraction of national income, France, 1820–2010

Figure 11.2. The mortality rate in France, 1820–2100

Figure 11.3. Average age of decedents and inheritors, France, 1820–2100

Figure 11.4. Inheritance flow versus mortality rate, France, 1820–2010

Figure 11.5. The ratio between average wealth at death and average wealth of the living, France, 1820–2010

Figure 11.6. Observed and simulated inheritance flow, France, 1820–2100

Figure 11.7. The share of inherited wealth in total wealth, France, 1850–2100

Figure 11.8. The annual inheritance flow as a fraction of household disposable income, France, 1820–2010

Figure 11.9. The share of inheritance in the total resources (inheritance and work) of cohorts born in 1790–2030

Figure 11.10. The dilemma of Rastignac for cohorts born in 1790–2030

Figure 11.11. Which fraction of a cohort receives in inheritance the equivalent of a lifetime labor income?

Figure 11.12. The inheritance flow in Europe, 1900–2010

Figure 12.1. The world’s billionaires according to Forbes, 1987–2013

Figure 12.2. Billionaires as a fraction of global population and wealth, 1987–2013

Figure 12.3. The share of top wealth fractiles in world wealth, 1987–2013

Figure 12.4. The world capital/income ratio, 1870–2100

Figure 12.5. The distribution of world capital, 1870–2100

Figure 12.6. The net foreign asset position of rich countries

Figure 13.1. Tax revenues in rich countries, 1870–2010

Figure 14.1. Top income tax rates, 1900–2013

Figure 14.2. Top inheritance tax rates, 1900–2013

Footnotes

References

;

| Author | volume | Date Value | title | type | journal | titleUrl | doi | note | year | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2014 CapitalintheTwentyFirstCentury | Thomas Piketty (1971-present) | Capital in the Twenty-First Century | 2014 |